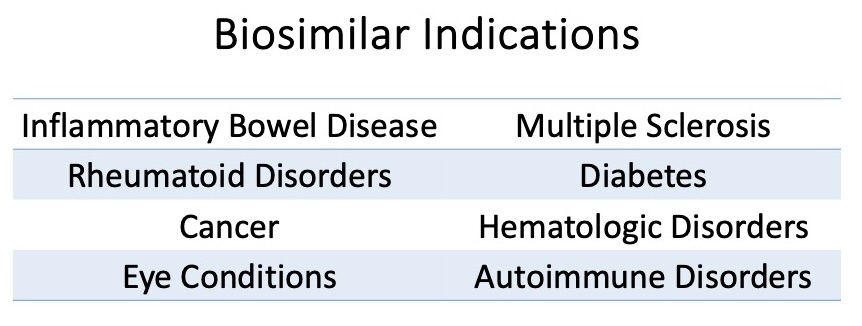

Looking at the current direction of therapeutic development, it is obvious that more biologics will be introduced to manage chronic disease. Biologic agents will dominate in the realm of rare, chronic, and autoimmune disease treatment and biosimilars for biologic products will rapidly follow to compete for part of the market share. While these agents amount to less than 3% of all prescriptions, biologics are responsible for more than 50% of all spending.1 Hence, the introduction of biosimilars into the market can provide much needed relief for health plans providing coverage of advanced therapeutic options for a variety of disease states, and some agents can be utilized to manage multiple conditions (see Table 1).

Table 1

Biologics vs. Biosimilars:

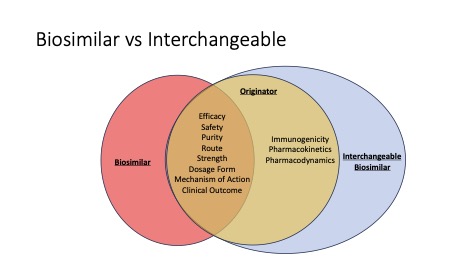

Biologics are human-made proteins derived from natural products. They are typically more specific when targeting the cause of a chronic disease. A biosimilar is an agent made from the same types of natural products and provide the same treatment risks and benefits of a specific biologic, often referred to as its “originator” or “reference product.” The FDA has created a process to ensure these agents meet specific requirements ensuring patients will derive the same therapeutic outcome when using a biosimilar that they would expect from the originator or reference product. Some agents go a step further by meeting additional “likeness” criteria, allowing the biosimilar to be identified as an Interchangeable that may be substituted without prescriber intervention (see Figure 1). 3

Figure 1: The relationship between biologic originator, biosimilar and interchangeable biosimilar.3

Currently, there are 42 FDA approved biosimilars, 17 in the pipeline, and over 700 clinical trials for biosimilars being conducted worldwide.1 As new agents enter the market, they provide greater access to life-changing therapy by driving down prices with increased competition. In 2022 alone, biosimilars saved $9.4 billion in the United States. This is almost 40% of the total savings realized in the United States since their market entry in 2015. Along with savings, these agents are responsible for 344 million incremental days of patient therapy that would not have occurred. 1

Challenges to Biosimilar Uptake:

Obviously, biosimilars can result in a significant decrease in prescription spend while meeting the same desired clinical outcomes, but there are still obstacles to their uptake in patient care.

Federal Regulations:

As described above in Figure 1, a reference product may have a biosimilar or an interchangeable biosimilar. Biosimilars are not automatically utilized in the prescription fulfillment process the way available generic agents are substituted. It would be treated as a therapeutic equivalent, and the prescriber needs to approve the medication change. Only interchangeable biosimilars can be substituted for the reference product without the intervention of the prescribing healthcare provider. 3

Patient and Provider Acceptance:

Consumer and provider confidence plays a role when selecting a biosimilar or switching to one, especially for the patient who has struggled through multiple biologics to gain control or induce remission of his/her disease. Comfort and confidence take time.

Pricing and Market Manipulation:

Pricing of biosimilars can be difficult to assess compared to reference products, as some agents are launching with two wholesale acquisition costs, with higher rebates and higher WACs to gain access to certain markets. This can result in higher costs to the patient despite an overall cost that is less than the originator. Reference products are sometimes included on the formulary and are covered in a similar manner as the biosimilar, giving little incentive for patients or providers to make changes. Some benefit managers have step-through policies in place, meaning the patient must fail brand first, creating yet another obstacle to biosimilar use.

These issues can create significant barriers to maximizing the cost-savings biosimilars can provide to the patient and third-party payor. If you are interested in learning more, contact Profero Team for guidance on how to evaluate the opportunities to reduce pharmacy plan costs.

References:

(1) The U.S. Generic & Biosimilar Medicines Savings Report. Association for Accessible Medicines. SEPTEMBER 2023

(2) https://www.fda.gov/drugs/therapeutic-biologics-applications-bla/biosimilars

(3) The Journey from Biologic to Biosimilar—A Clinical Perspective. Clinical Researcher—January 2021 (Volume 35, Issue 1). Wasi Akhtar, BPharm, MBA